Current perspectives on the biopharma go-to-market model

Mind the gap! Why the disparity between the go-to-market strategies companies should be implementing and are implementing represents a great opportunity for biopharma

An Introduction by Executive Insight

With increasing pressures on healthcare systems, the rise in power of different stakeholders such as payers, patients and policy makers, and the launch of highly specialised/rare treatments, such as personalised medicines, the traditional go-to-market models for pharmaceutical products are no longer fully fit for purpose. The survey results contained within this report support the fact that most within the industry are aware of this.Yet they also show that the uptake of new strategies has, to-date, been modest. So why is this?

In a volatile environment most biopharma companies, perhaps understandably, prefer to play it safe. They gravitate towards those strategies with which they are historically more experienced, such as employing key account managers with large institutional customers. However, more recently, biopharma companies have started to embark on game-changing strategies such as:

- Offering unique business/healthcare services, e.g. individualised patient dosing supported by holistic solutions including required devices

- Leveraging product portfolio synergies, e.g. TA/franchise competition across products, both for innovative brands and/or mature/established products

- Realigning responsibilities to a supranational level, e.g. dedicated pan-European business units, particularly in rare diseases, oncology and other specialty care areas

After pulling any game-changing levers other commercial levers will need to be re-assessed and possibly adjusted. For those companies who embrace a ‘white sheet’ approach to their go-to-market model, there are many potential advantages. In the long-run, they will optimise stakeholder engagement, sustain superior competitiveness and improve the bottom-line, reported to be the three main go-to-market objectives.

It is time for the biopharmaceutical industry to close the gap and recoup the benefits, as those players who have established novel industry standards have already done, thereby raising stakeholders’ expectations to a new high-ground.

Current perspectives on the biopharma go-to-market model

A new survey of 36 pharmaceutical industry executives, conducted by FirstWord, sheds light on the launch strategies currently being employed by biopharmaceutical companies for their (new) products, and how these are likely to change in light of market and in uencer dynamics.

The rise of payers and patients

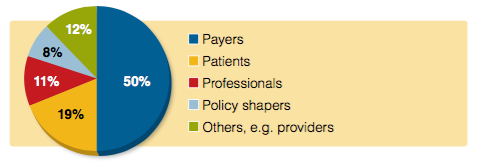

Respondents were asked which healthcare stakeholders or institutions will increase most in importance for their company in the next two years. The most common response was payers, with half of all respondents selecting this option, while 19% opted for patients and 12% for professionals.

The focus on payers and patients is perhaps unsurprising. Healthcare is being fundamentally changed by two significant trends. First, with healthcare budgets increasingly squeezed, we see the first signs of pay-for-performance models. This puts the role of payers absolutely front and centre. To improve the financial success of a branded drug, manufacturers must embrace the needs of payers at every stage in a new drug’s development and commercialisation process, which necessitates involving them early-on in the process, including in the design of clinical development programs for early assets.1

Secondly, new technologies such as social media and smartphone apps, are giving patients more control over their own health and projecting the patient voice to the point where it demands to be heard. It has already been reported that patient consultation enriches the content of health technology assessment reports and their recommendations.2

Figure 1: Which healthcare stakeholders/institutions will increase most in importance for your company in the next 2 years?

Maintaining a competitive advantage

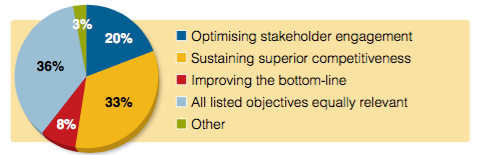

Respondents were asked which objective was most important to their company when preparing a product for the market. The single most important objective was “sustaining superior competitiveness”, compared with “optimising stakeholder engagement” (20%) and “improving the bottom line” (8%). However the answer with the highest number of respondents (36%) was that all three are of equal importance.

They are fundamentally linked - stakeholder engagement is critical to maintaining a competitive advantage and, in turn, improving the bottom line. Unless a new product is first-in-class or significantly differentiated in some way, pharmaceutical companies can no longer rely on the product alone to demonstrate its own value. Rather, the product must now be a part of a compelling package of services, proven to make a positive impact on healthcare systems. This value can only be determined and agreed through optimised stakeholder engagement.3

Figure 2: Which go-to-market objective is most important for your company today?

New strategies are needed

A changing healthcare environment, such as the aforementioned shift in power of different stakeholders, and ever increasing business pressures to maintain a competitive advantage, needs to be reflected in commercial strategies.

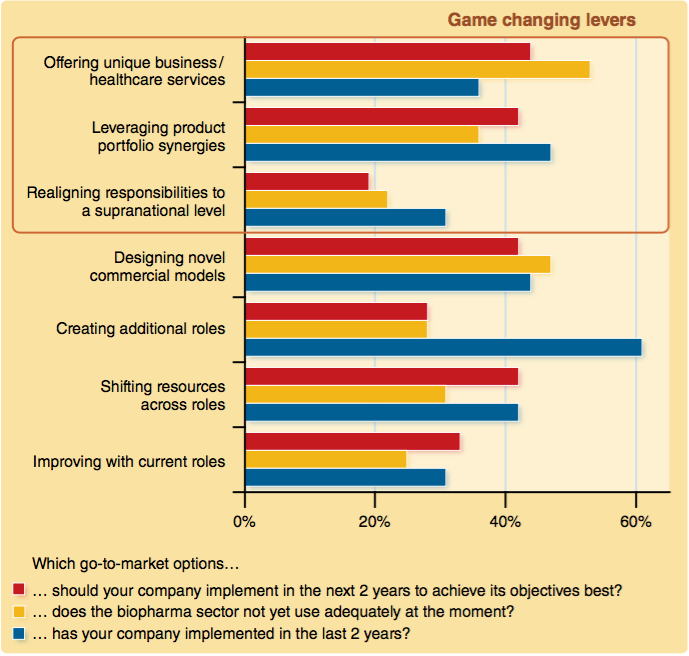

Respondents were asked which strategies their companies had employed in getting a product to market in the last two years, which ones they should implement in the next two years, and which ones are being under used by the industry as a whole.

The two major strategies employed by companies in the past two years are “creating additional roles” and “leveraging product portfolio synergies”. That companies have created additional roles to manage product launches is a clear reaction to the changing environment and the need to be able to communicate well with new in uencers, particularly payers. Pharmaceutical companies must build a strong understanding of benefits that resonate with payers, namely public health benefits, economic benefits and breakthrough clinical benefits.4

In addition, leveraging product portfolio synergies has clearly worked well for companies such as Novo Nordisk, who recently reclaimed their global diabetes market leadership crown from Sanofi, after focusing on therapeutic area leadership.5

Perhaps most interestingly of all, over half of all respondents (53%) indicated that “offering unique business/healthcare services” was currently the area most under-exploited by the pharmaceutical industry. This survey found only 36% of companies had implemented this strategy in the past two years. In an ever-increasingly competitive and overcrowded marketplace, it is vital to have services in place which support stakeholders, such as payers and patients, in meaningful ways along the patient pathway, and that clearly differentiate products.6

Many respondents agree that their companies should increasingly be offering unique services over the next two years and a similar percentage (42%) say they need to design novel commercial models. These commercial models may provide the required unique differentiator. Meanwhile 42% also suggest that “shifting resources across roles” should be a focus for their company, again reflecting the changing needs of stakeholders.

Which geographic markets are you responsible for?

Global: 30%

Region: 28%

One or more European countries, e.g. top 5: 28%

Other/not applicable: 14%

Which profit & loss (P&L) items are you held accountable for?

(indicate all that are applicable)

Revenues: 53%

Marketing expenses: 39%

Selling expenses: 31%

Functional expenses: 42%

General & administrative expenses: 22%

Other/not applicable: 17%

- Wenzel M, Hall C. Opposites Attract: Pairing R&D and Commercial Teams. Pharmaceutical Executive. 2015 May 5.

- Dipankui MT, Gagnon MP, Desmartis M. Evaluation of patient involvement in a health technology assessment. Int J Technol Assess Health Care. 2015 Jan;31(3):166-70. doi: 10.1017/ S0266462315000240. Epub 2015 Jun 11.

- Ruzicic A, Flostrand S. If the shoe ts. Pharmaceutical Marketing Europe, January/February 2010: 20-24.

- Pesse M, Boggio M. Sever Weather Warning. Pharmaceutical Market Europe, September 2015: 40-42.

- Adams B. Novo Nordisk becomes diabetes drug sales leader. PMLive, 2015 June 16.

- Wenzel M, Henne N, Zöllner Y. Beyond the pill – the move towards value-added services in the pharmaceutical industry. Journal of Medical Marketing. 2014 May-August;14(2-3):91-98.