Opposites Attract: Pairing R&D and Commercial Teams

Without insights from Commercial functions at an earlier stage of drug development, R&D teams can miss crucial information which can cost pharma companies billions. Here Executive Insight’s Meike Wenzel and Clifford Hall examine a new concept for early commercialization planning to facilitate good cross-functional working practice.

Forbes recently estimated that the average cost of developing a single drug is now around $5 billion per medicine. It’s a figure that is only set to increase - the number of new medicines invented per billion dollars spent is halved approximately every 9 years. A major reason for the high cost is the disproportionately high rate of failure; as many as 95% of the medicines that are studied in humans fail to meet the standards required for approval.

In an era when pharma is increasingly under the microscope for high drug prices, such a model appears to be unsustainable.

The most expensive stage of development is Phase III onwards, so when a drug fails clinically at this stage, or if it fails commercially despite regulatory approval, the consequences can be dire. Clinical failure cannot always be predicted or prevented, but commercial failure often can be. If the needs of patients, physicians and payers are not considered early enough, it can delay uptake or impede the chance of success.

Learning lessons from the past

Gaining insights from Commercial during an early stage (e.g. Phase I-II) could help to reduce this risk. In a recent survey of 150 R&D executives by Heidrick & Struggles, 53 percent cited lack of coordination between the R&D and Commercial functions for industry’s declining scientific productivity.

Exubera may be the most high-profile example of what can go wrong when patient needs and expectations are not considered early enough. Inhalable insulin was thought to be the answer to non-compliance for diabetics who disliked injecting insulin on a regular basis, and expectations were high. However, the product was not well received by either patients or physicians.

First of all, the product came with a requirement that all patients undergo a lung function test before the initiation of therapy – this created an extra step in the treatment process, one that was neither practical nor feasible for endocrinologists. Secondly, it had an extremely large drug delivery device, which was inconvenient for patients to carry. Finally, and perhaps most damningly, the unmet need which it supposedly solved – namely patients' aversion to needles – was virtually a non-problem by the time Exubera came to market due to reduced needle sizes and increased patient acceptance.

The lack of foresight – and arguably the lack of Commercial input at an early enough stage during R&D – transformed an eagerly anticipated innovation into a $2.8 billion failure.

Similarly Benlysta, a first-in-class treatment for lupus, failed to meet sales expectations because it did not address the needs of payers. Despite approvals from FDA and EMA and a high unmet medical need in the therapy area, payers concluded that GSK failed to provide the relevant data to assess the benefit of its medicine versus optimised standard therapy, and that the applicability of its trials to real world clinical practice was not clear.

R&D and commercial – a marriage made in heaven?

As a result of these kinds of difficult lessons, leading pharma companies are starting to implement organisational and cultural changes to unite R&D and Commercial and direct them toward shared objectives early in development.

Companies are beginning to accept that they can improve early-stage decision making and enhance product development using commercial insights to gain an overall competitive advantage in the marketplace.

Indeed, Mannkind heeded the lesson from Exubera with its own version of inhaled insulin; it listened to what the market needed early on in the development process. Its Afrezza inhalers are small, discreet and acceptable to patients. Unlike Exubera, it is also breath-activated, increasing patient convenience and reliability.

The benefits of early-stage involvement

As companies move into clinical testing (Phase I / Phase II), Commercial teams can provide market insights into the most important stage of disease, key target patient population information and most relevant clinical comparator drug information. This can avoid mistakes being made in these areas, which can be expensive and slow down the time to market.

Ultimately Commercial can provide the insights from key stakeholders – i.e. what is most important to patients, physicians and payers – which can help to actually shape product development strategy and innovation. By highlighting ‘real world’ unmet needs and preferences, Commercial teams can help to steer the course of a drug, device or service offering as the company seeks to solve those specific issues that truly matter most to stakeholders.

The challenges faced

The partnership sounds good in theory – in practice, the road can be a bumpy one. Cross-functional collaboration is important, but not easy to build - R&D and commercial operations are not well integrated and aligned with each other and are often accustomed to working in their own silos. The mind-set is very different; and neither group sees themselves as particularly connected to the other.

From a resourcing perspective, it can be challenging to engage Commercial input on drugs that are still several years from launch, as Commercial teams are often prioritised on working with other drugs which are in mid-to-late stage development.

From a process perspective, it requires quite a significant organisational change to support cross-functional collaboration, both in terms of feeding market and customer insights upstream and R&D findings downstream.

If there is one thing that exemplifies the lack of commercial input at an early stage, it is target product profiles (TPPs). In theory, TPPs are business documents for all the team members, senior management and agencies to help them understand what the product is. But these are usually very detailed and technical descriptions, which do not describe how value will be delivered.

The solution – from TPP to TVP

We propose an early commercialisation planning process, which is the joint responsibility of R&D and Commercial functions. This requires in-depth interactive sessions and communication between R&D and Commercial where potential areas for adding value can be discussed and explored at an early stage.

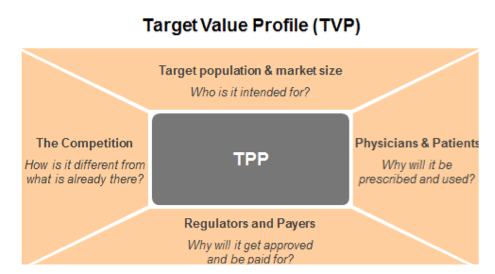

We suggest a TVP – Target Value Profile – to supplement a regular TPP by introducing the idea of value at an early a stage as possible. The TVP is an aspirational description of how pharma plans to deliver value to the market, and acts as a guiding light for all within the organisation to know where the product is going.

The TPP remains a central document (see image), but within the expanded TVP, a range of questions should be considered for the key stakeholders – for example:

Patients: Who are the ‘right’ patients and what does their patient journey look like? What challenges do patients currently face e.g. from an emotional, medical and financial perspective? What are the outcomes that matter most to patients? How could the patient experience be improved e.g. through different formulations, devices, etc.?

Physicians: What challenges do physicians face when treating patients with the disease? What are the treatment decision criteria for primary and specialty care physicians? What are the outcomes that matter most to them?

Payers: How will a payer’s population be impacted? Will the drug be able to demonstrate a significant difference in outcomes for patients? What would make payers willing to pay for the drug?

Regulators: How will the drug compare against the standard of care? Will we be able to demonstrate any significant differences? What will be the ideal comparators and trial size and duration?

The key is to start “outside-in” – in other words to consider the wider environment and see what the requirements are, irrespective of your drug – and to explore what value could look like for stakeholders in, for example, 8-10 years from today.

A TVP as described above – with regular revisits to reflect any external changes in the wider environment – is a very simple-to-implement process that will provide clear guidance on how trials need to be shaped and designed to produce evidence that supports the unmet needs identified.

Neither the R&D or Commercial functions can act entirely in a vacuum – they need each other from an early stage. R&D without Commercial can go up the wrong path, wasting billions in the process. Commercial without R&D has no way to plan a meaningful commercial strategy. The TVP becomes, in a way, like a central contract between R&D and Commercial – a common cause to aid their collaboration, with mutual benefit to both function, the organization and ultimately, for the patients who receive new, innovative medicines.