Countdown to an optimized drug launch: 5 determinants of success

Just as the success of a rocket launch depends on a combination of factors – thrust, location, design, and launch window –the launch of a new pharmaceutical product depends on a host of determinants as well. It takes just one factor to send the launch awry and lead to lower-than-expected sales trajectory.

A recent analysis of 50 drug launches in the US revealed that only 12% demonstrated a relatively accurate sales forecast.1 Disappointing sales figures can lead to wasted company resources, volatility in stock prices, and ultimately, limited patient access to potentially life-saving treatments.2

There have been some high-profile examples in recent years. Novartis had high hopes for Beovu, its VEGF inhibitor for wet AMD when it launched in 2019. However, after the American Society of Retina Specialists flagged a potentially vision-damaging safety risk, the product’s value proposition diminished in the eyes of stakeholders, and sales tumbled.3 Despite a clear unmet need for Bluebird Bio’s Zynteglo, a gene therapy for an ultra-rare blood disorder, the product failed to hit initial forecasts. In the US, two-thirds of eligible patients remained unsure about gene therapy4, while in Europe, the product was withdrawn after unsuccessful price negotiations.5

Of course, the reasons for suboptimal performance are usually clear in retrospect. The challenge for pharmaceutical companies is to identify and manage them before launch.

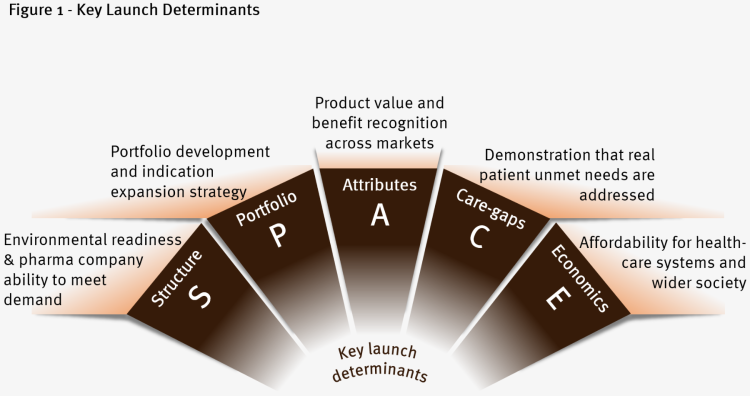

Reaching SPACE: 5 determinants to ensure an optimal launch

The launch is a one-off opportunity to get the sales trajectory right from the start. Below are five key determinants to consider when planning a launch.

For each, we will outline the key challenges and recommendations for launch excellence.

1. Structure

Sometimes, the market isn’t ready for a new product, or the company isn’t quite ready to meet the demand for it. The clearest examples of ‘structural unreadiness’ are when completely new innovations come to market, requiring novel patient and funding pathways.

Despite being perceived as “cancer’s newest miracle cure,”6 CAR T-cell therapies remain significantly underutilized. Common challenges include timely identification and referral of eligible patients, funding approval by authorities and payers, and resource needs at CAR T-cell centers.7 Pharma companies have also needed to master the complex manufacturing process and supply chain challenges over time.

But it’s not only therapies without existing blueprints that struggle with structural readiness. A review of 91 drugs that performed below expectations revealed that therapies often perform poorly due to a lack of market preparation and stakeholder education, including limited understanding of the patient population.8

Launch excellence: During the early phases of clinical development, all complexities in terms of administration, manufacturing and delivery must be considered. If the product has no existing pathway, then significant foundational work must be done to ensure the capabilities, knowledge and stakeholder relationships are in place before launch.

Barriers should be identified at every stage of the patient pathway so that companies can work with healthcare system partners to co-create solutions.

2. Portfolio

There are clear benefits to introducing new therapies into areas where companies have established capabilities. It’s for this reason that small and midsize companies often fare better with launch success.8

Launches in therapeutic areas where the company is already established show significantly higher average revenues per product compared to launches in non-core therapeutic areas — $670 million versus $280 million.9

Meanwhile, lifecycle opportunities, including potential indication expansions, can boost and protect long-term revenue. In a crowded PD-1/PD-L1 inhibitor market, Keytruda maintained a dominant share through approval across multiple indications, accumulation of a wealth of data, and significant oncologist experience.10 On the flipside, multiple trials and indications can potentially raise greater uncertainties and risk losing focus on the core indication.

Launch excellence: If companies can utilize an established commercial infrastructure, then it is likely to improve launch uptake.

Careful planning around the sequence of potential add-on indications, new lines of therapy or patient segments while considering price erosion in key markets and investments, can help to ensure continued success.

3. Attributes

In often crowded and complex healthcare systems, the reasons to fund or prescribe a new treatment may not be immediately clear. Change requires a compelling value case.

But how value is defined by regulatory and HTA bodies around the world – and how evidence is included and evaluated – differs considerably.11

While the new joint HTA procedure launching in Europe in Q1 2025 may help to streamline workflows, there are also concerns that it may lead to additional layers and greater duplication of effort.12

Launch excellence: Successful therapies are those that can clearly align their value with the needs of all stakeholders. Developing a core value proposition, which resonates with all priority audiences across clinical value, health economic value, patient value, and more, is essential. A compelling narrative should resonate regardless of national differences.

4. Care-gaps

Central to any value story is demonstrating clear unmet needs and how the product addresses these, in ways that are most meaningful to patients. But many outcomes are relatively subjective, e.g., those dependent on assessor judgment, patient-reported outcomes, or private phenomena only assessable by the patient.13

For example, a recent study revealed substantial differences in the perception of disease severity between post-COVID-19 patients, internists, and psychiatrists or psychologists.14 Such discrepancies make it challenging to clearly demonstrate the unmet need being addressed.

Launch excellence: When designing clinical trials, pharma companies should prioritize endpoints that allow a clear and unbiased interpretation, which translates into meaningful patient impact. Accepted and standardized scores and tools should be utilized to accurately assess patient outcomes and clearly demonstrate that the unmet needs –for patients, payers and policy makers– have been addressed.

5. Economics

Proving economic value has never been more important as all healthcare systems are stretched. Many innovative medicines come with high price tags and elements of uncertainty – for example around long-term benefits and side effects, whether that’s one-off cell & gene therapies or the next-generation of anti-obesity drugs. The combination of high price and high uncertainty is a challenging one for payers.

Launch excellence: Companies increasingly need to embrace value-based agreements to address uncertainties – including pay for performance agreements or conditional reimbursement agreements, while RWE is collected.

Early pre-launch engagement is needed to get the necessary planning and preparations underway with different payers – for example, testing of value-based pricing strategies and agreements, and ensuring that the data infrastructure needed to collect evidence on patient outcomes in the real world is in place.

Towards the launch excellence horizon

There are many different elements to a drug launch, all of which must come together at the same time to enable success.

At the core is understanding exactly how the product meets the needs of patients, other stakeholders, healthcare systems and society. Internally, companies must consider the launch phase of a new therapy in a holistic, cross-functional and non-siloed way. Being first to market is not necessarily the most important aspect; sometimes, launching later, with a clear launch horizon in place, is preferable.

Ultimately, like a rocket launch, it’s mainly about good planning and good teamwork. And when it all comes together, the product will skyrocket – with a positive trajectory for the future.

Read the original article published in PME magazine October 2024 here: https://pmlive.com/wp-content/uploads/2024/10/PME-OCT24-DIGITAL.pdf

References

1 Simon Kucher. The wild west of sales forecasting in pharmaceuticals: When expectation meets reality. 2024. Available at: https://www.simon-kucher.com/en/insights/wild-west-sales-forecasting-pharmaceuticals-when-expectation-meets-reality

2 World of DTC Marketing. Why Financial Analysts Often Miss the Mark: Understanding the Difficulty of Forecasting New Pharma Drug Sales. 2023. Available at: https://worldofdtcmarketing.com/why-financial-analysts-often-miss-the-mark-understanding-the-difficulty-of-forecasting-new-pharma-drug-sales/

3 Fierce Pharma. Novartis calls off 3 Beovu trials testing more frequent dosing on concerns of vision-threatening side effect. 2021. Available at: https://www.fiercepharma.com/marketing/novartis-takes-its-eyes-off-3-beovu-trials-more-frequent-dosing-safety-concerns

4 Reuters. Bluebird falls on worries over $2.8 mln gene therapy's commercial success. 2022. Available at: https://www.reuters.com/business/healthcare-pharmaceuticals/bluebird-bio-falls-worries-over-gene-therapys-commercial-success-2022-08-18/

5 Biopharmdive. Bluebird, winding down in Europe, withdraws another rare disease gene therapy. 2021. Available at: https://www.biopharmadive.com/news/bluebird-withdraw-gene-therapy-europe-skysona/608666/

6 Time Magazine. Cancer’s Newest Miracle Cure. 2017. Available from: https://time.com/4895010/cancers-newest-miracle-cure/

7 Canales Albendea MÁ, Canonico PL, Cartron G, et al. Comparative analysis of CAR T-cell therapy access for DLBCL patients: associated challenges and solutions in the four largest EU countries. Front Med (Lausanne). 2023 May 30;10:1128295. doi: 10.3389/fmed.2023.1128295. PMID: 37324138; PMCID: PMC10263061.

8 Deloitte Insights. Drug launches reflect overall company performance. 2023. Available at: https://www2.deloitte.com/us/en/insights/industry/health-care/key-factors-for-successful-drug-launch.html

9 LEK. Variability in Large Pharma Launch Performance. Available at: https://www.lek.com/insights/hea/us/ei/variability-large-pharma-launch-performance

10 IQVIA. In the Eye of the Storm: PD-(L)1 Inhibitors Weathering Turbulence. 2022. Available at: https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/iqvia_in-the-eye-of-the-storm_pd-1-inhibitors-weathering-turbulence_05-22-forweb.pdf

11 Angelis A, Lange A and Kanavos P. Using health technology assessment to assess the value of new medicines: results of a systematic review and expert consultation across eight European countries Eur J Health Econ (2018) 19:123–152

12 Abacus Medicine. The EU joint HTA procedure: a gate or barrier for access? Available at: https://abacusmedicinepharmaservices.com/the-eu-joint-hta-procedure-a-gate-or-barrier-for-access/

13 Moustgaard H, Bello S, Miller FG, Hróbjartsson A. Subjective and objective outcomes in randomized clinical trials: definitions differed in methods publications and were often absent from trial reports. J Clin Epidemiol. 2014 Dec;67(12):1327-34. doi: 10.1016/j.jclinepi.2014.06.020. Epub 2014 Sep 26. PMID: 25263546.

14 Ruzicka, M., Ibarra Fonseca, G.J., Sachenbacher, S. et al. Substantial differences in perception of disease severity between post COVID-19 patients, internists, and psychiatrists or psychologists: the Health Perception Gap and its clinical implications. Eur Arch Psychiatry Clin Neurosci (2023). https://doi.org/10.1007/s00406-023-01700-z